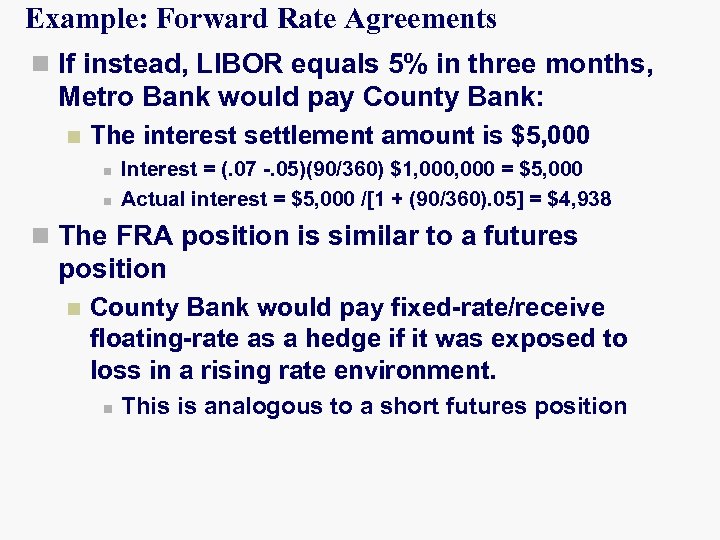

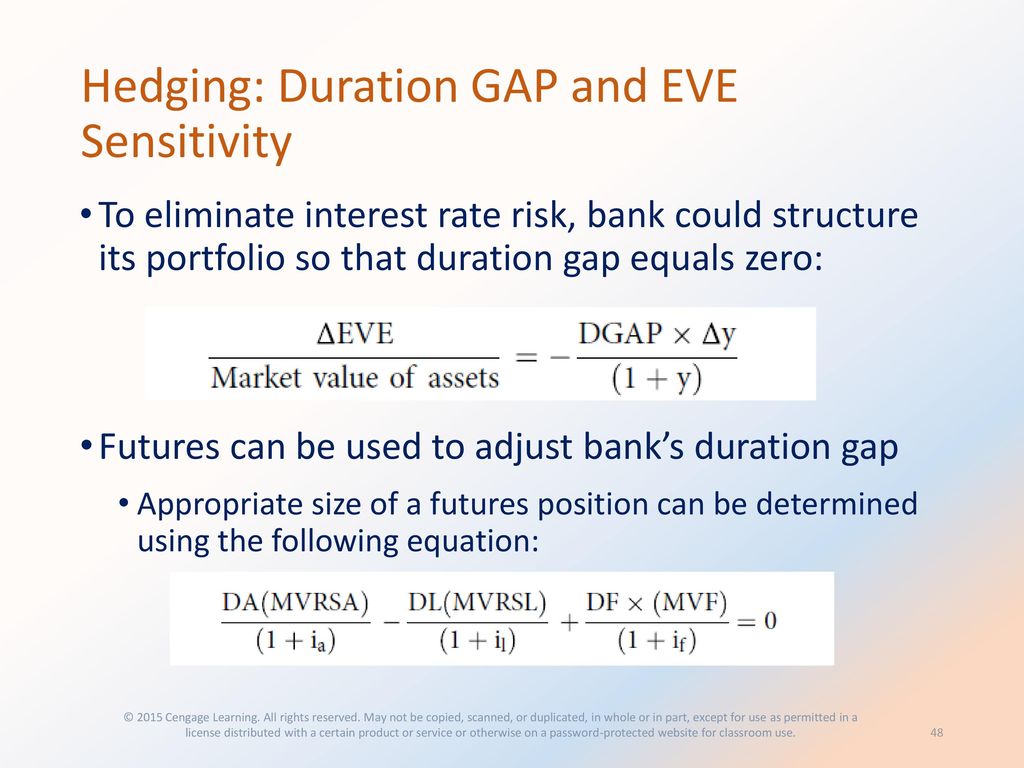

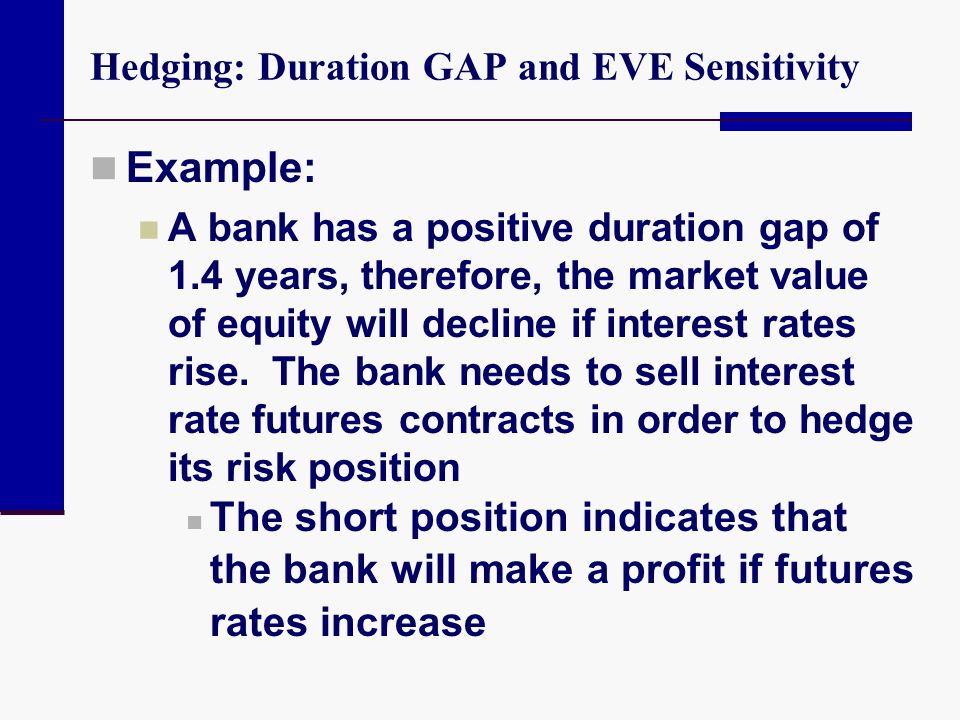

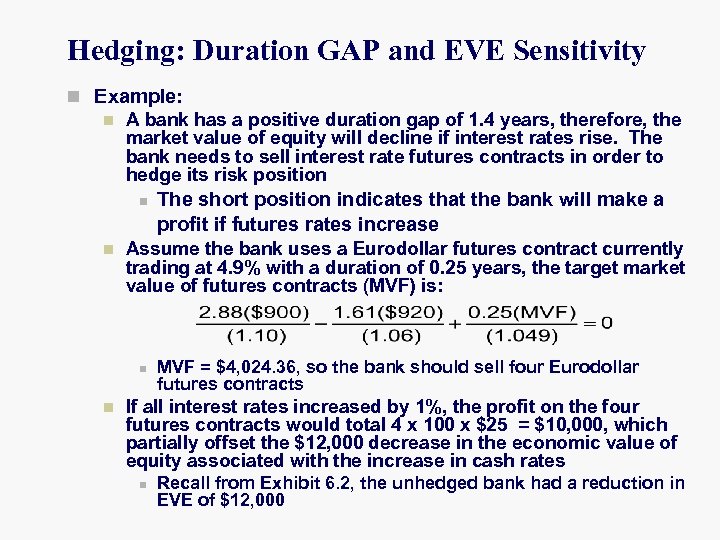

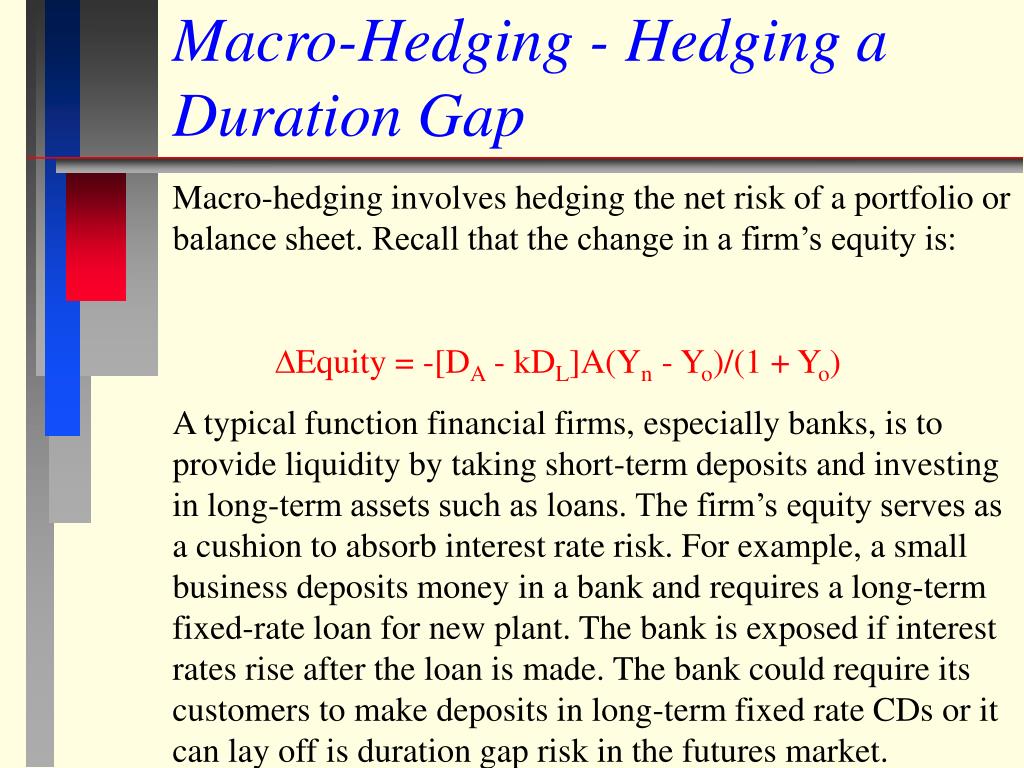

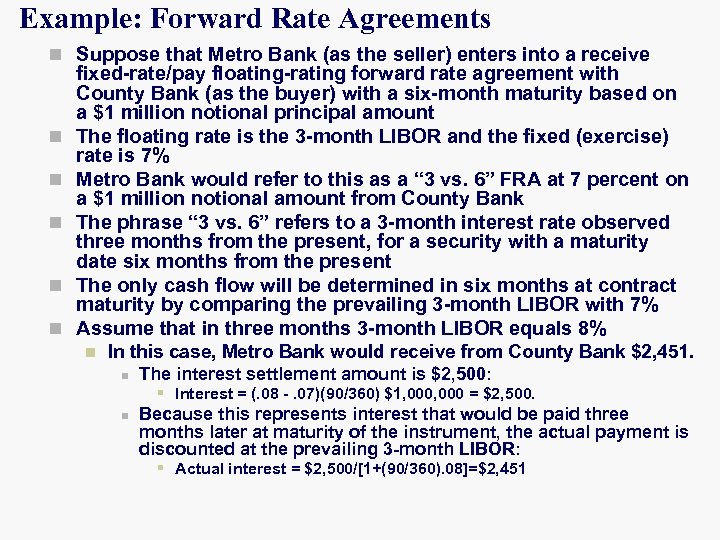

Derivatives in ALM. Financial Derivatives Swaps Hedge Contracts Forward Rate Agreements Futures Options Caps, Floors and Collars. - ppt download

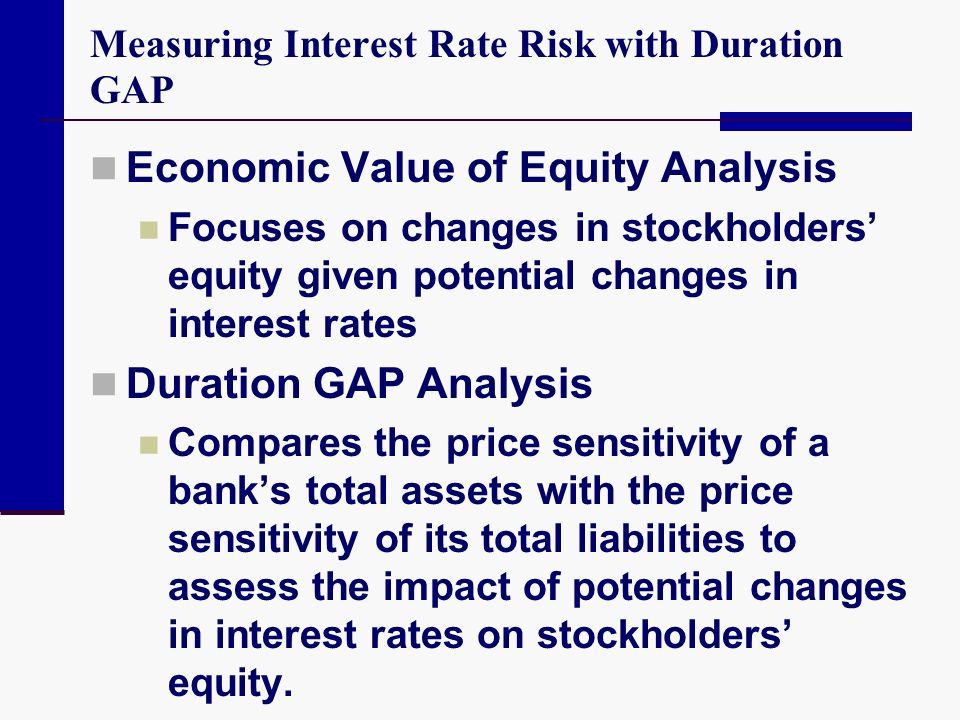

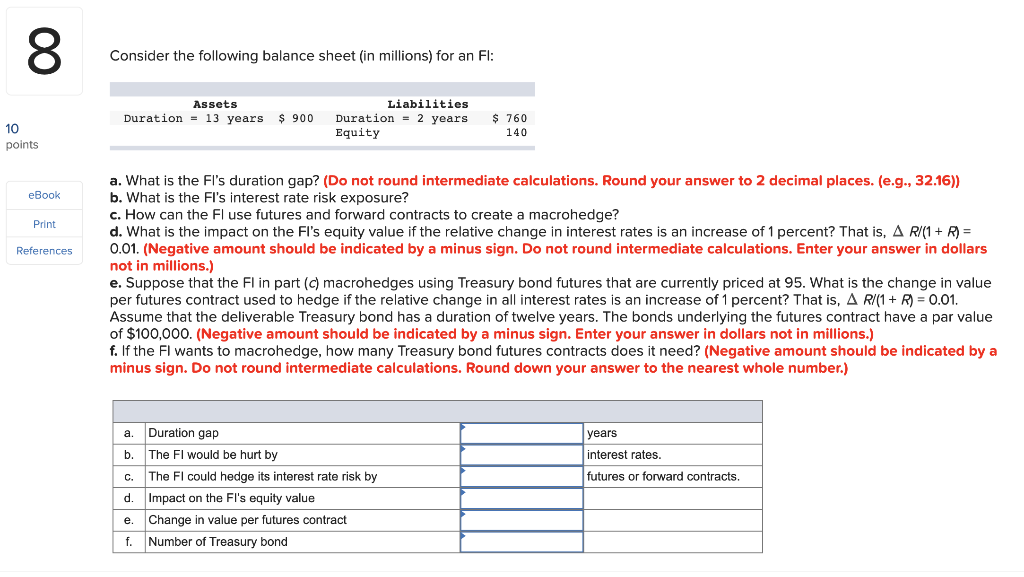

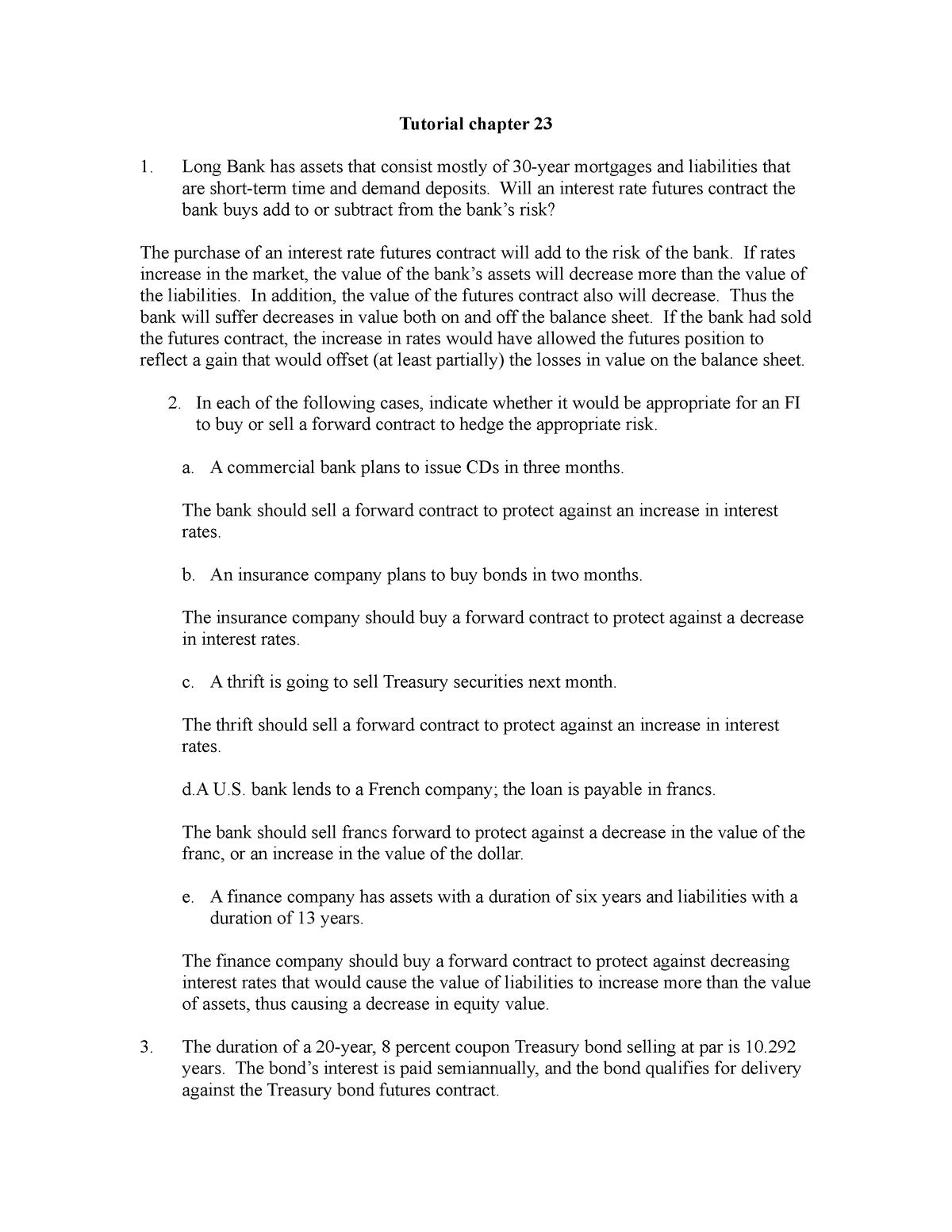

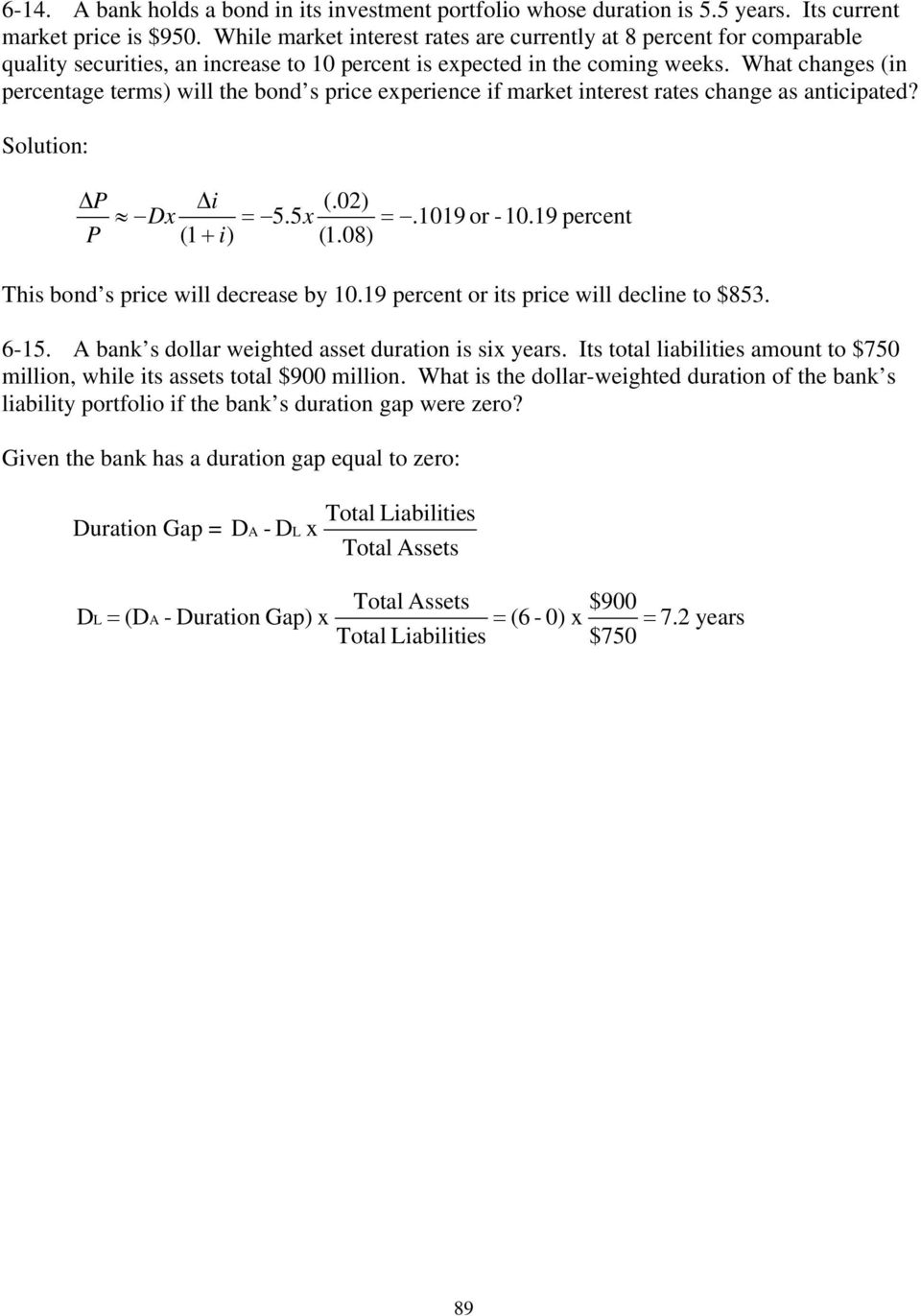

CHAPTER 6 ASSET-LIABILITY MANAGEMENT: DETERMINING AND MEASURING INTEREST RATES AND CONTROLLING INTEREST-SENSITIVE AND DURATION GAPS - PDF Free Download

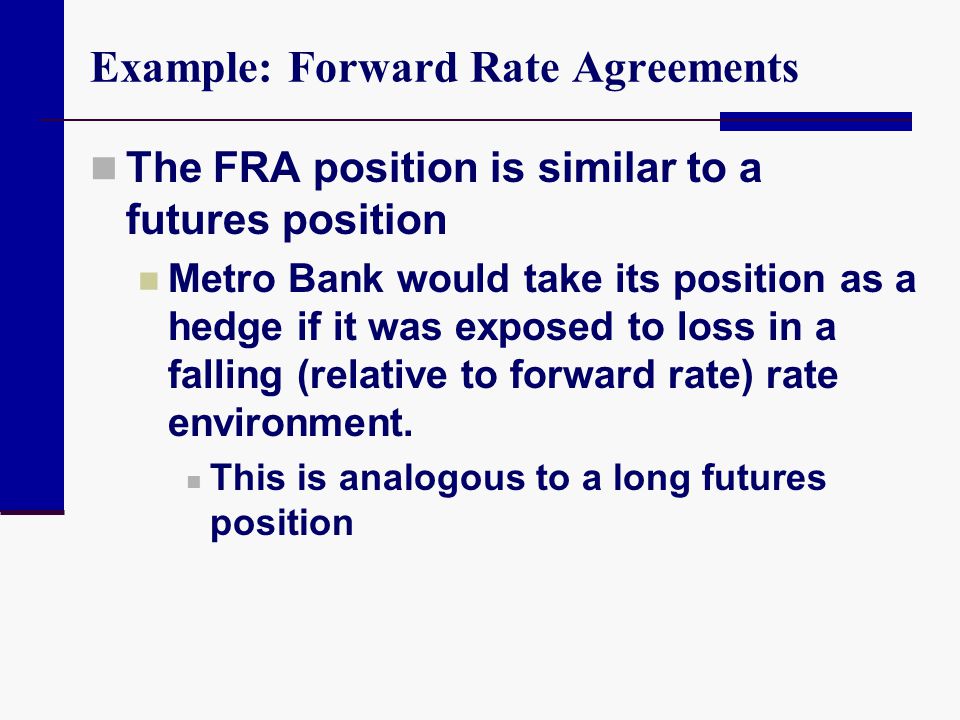

Forward Rate Agreement | Definition | Formula | Timeline Graph | Hedging with FRA | Calculation Example